In today’s world of finances, we can refer to a credit score as a sort of passport, which can either benefit or obstacle us. If you’re a young adult just starting your financial journey, understanding how to build credit is a crucial step toward securing your financial future.

The Importance of Building Credit Early

Getting credit probably isn’t the most exciting milestone in young adulthood. However, it is certainly one of the most important. Establishing a good credit record early on comes with many benefits that will last you for life.

A good credit score affects more things than you may realize. Beyond you being eligible for other people’s money (a loan or credit card), your score can have an impact on far more than getting credit.

- Housing opportunities: Most landlords review credit scores before approving leases.

- Employment prospects: Some employers review applicants’ credit histories as part of background checks.

- Insurance premiums: Insurance premiums are the rates charged by insurers to their policyholders.

- Utility services: Utility services may require security deposits for customers with poor credit history.

- Interest rates: The better your credit, the lower the rates you will get on loans and credit cards. In this case, a lower interest rate may save you thousands over time.

If you start your credit journey at a young age, you will have more time to establish your credit history. You will also have enough time to recover from any potential mistakes you might make. Finally, you will have time to cultivate proper financial behavior before making any big purchases.

Understanding Credit Scores

Before going into credit building, it is prudent to know what you are working with. A simple one-page application (available in the download box) can help you obtain an up-to-date credit score.

The scoring model that is the most commonly used is called FICO and this score is based on five factors.

- Payment history (35%): Your previous credit accounts paid on time account for 35% of the score.

- Credit utilization (30%): The amount of the credit you are using (30%)

- Length of credit history (15%): A long credit history is beneficial.

- Credit mix (10%): Number of credit cards and loans owned.

- New credit (10%): How frequently you apply for new credit.

Generally speaking, anything above a 670 is considered good while more than a 740 would be very good or amazing. If you’re new, you’re not going to get the score right away; it’s a credit history issue.

Steps to Start Building Credit

Building credit when you don’t have any can feel like a catch-22; you need credit to build credit. Still, there are a variety of ways young adults can establish credit profiles without significant history.

1. Become an Authorized User

One easy way to start your credit history is to be added as an authorized user on someone else’s credit card account, usually a parent or trusted family member.

How it works:

- The main cardholder adds you to their current credit card account.

- Their credit account history might be shown on your report.

- You now have a boost in your own positive credit history without you needing to get qualified on the card itself.

Important considerations:

- It’s important for the main cardholder to use credit responsibly, paying on time and keeping low balances.

- Check with the issuer of your credit card about the reporting of authorized user accounts to the credit bureau.

- Negative account activity can affect your credit score as well.

This approach gives you the opportunity to build your credit without the full responsibility of your own account.

2. Apply for a Secured Credit Card

Secured credit cards are also recommended for people with little or no credit history. They are a great starting point for young adults.

How it works:

- You pay a cash deposit in advance of usually $200-$500 which is your credit limit.

- This deposit is a security for the lender.

- Use the card sensibly as your issuer sends your activities to a credit bureau.

- After showing you can use a card responsibly for a while, usually 6 to 12 months, many issuers will return your deposit. Then, the issuers usually transition you to a normal unsecured card.

Tips for success:

- Choose a card with no annual fee if possible.

- Scheduling automatic payments is a great idea so that you never miss a date.

- Keep your credit utilization below 30% of your limit.

- Pay your balance in full each month to avoid interest charges.

A secured card works like a regular credit card for building your credit. The difference is that a security deposit is needed.

3. Consider a Credit-Builder Loan

Credit-builder loans allow you to save money while building credit so you can establish some sort of credit history.

How it works:

- You “borrow” a small amount (typically $300-$1,000).

- The cash goes into a locked savings account while you make monthly payments.

- When you’ve paid the total amount together with interest, the money is released.

- The credit bureaus are reported when you pay your payments.

Benefits:

- Aids in creating payment history, which is the most important factor in your credit score.

- Forces disciplined savings while building credit.

- No need for existing credit history to qualify.

You can potentially establish credit with the help of a credit-builder loan from community banks and credit unions.

4. Use a Co-Signer

When you may not qualify for a loan or credit card application, having someone with established credit willing to co-sign can help.

How it works:

- A creditworthy individual accepts equal responsibility for the debt incurred by the borrower.

- Your credit history and income help qualify you for the account.

- The activity on the account will show on your and the co-signer’s credit reports.

Important considerations:

- The co-signer will have significant responsibility as a result of this arrangement.

- Missed payments won’t damage your credit profiles, defaults will.

- Both credit reports will have the debt on them, which can hamper the co-signer from obtaining credit.

Trust and communication are required for co-signing arrangements. This is very useful for big purchases like auto loans when other credit-building options haven’t built up enough history.

5. Apply for a Student or Starter Credit Card

Many banks offer credit cards for students or first-time users that usually have less strict approval requirements.

Key features:

- Lower credit limits to minimize risk for both parties.

- Sometimes offer student-specific benefits or rewards.

- May not require extensive credit history for approval.

- Often include educational resources about building credit.

What to compare when choosing:

- Annual fees (aim for none if possible).

- You must pay in full each month, though they can charge interest.

- Select a rewards program that fits your spending habits.

- Credit limit increase policies.

Some credit card issuers also have pre-qualification tools. You can check your chances of approval with these tools. And it won’t impact your credit score through a hard inquiry.

Best Practices for Maintaining and Improving Credit

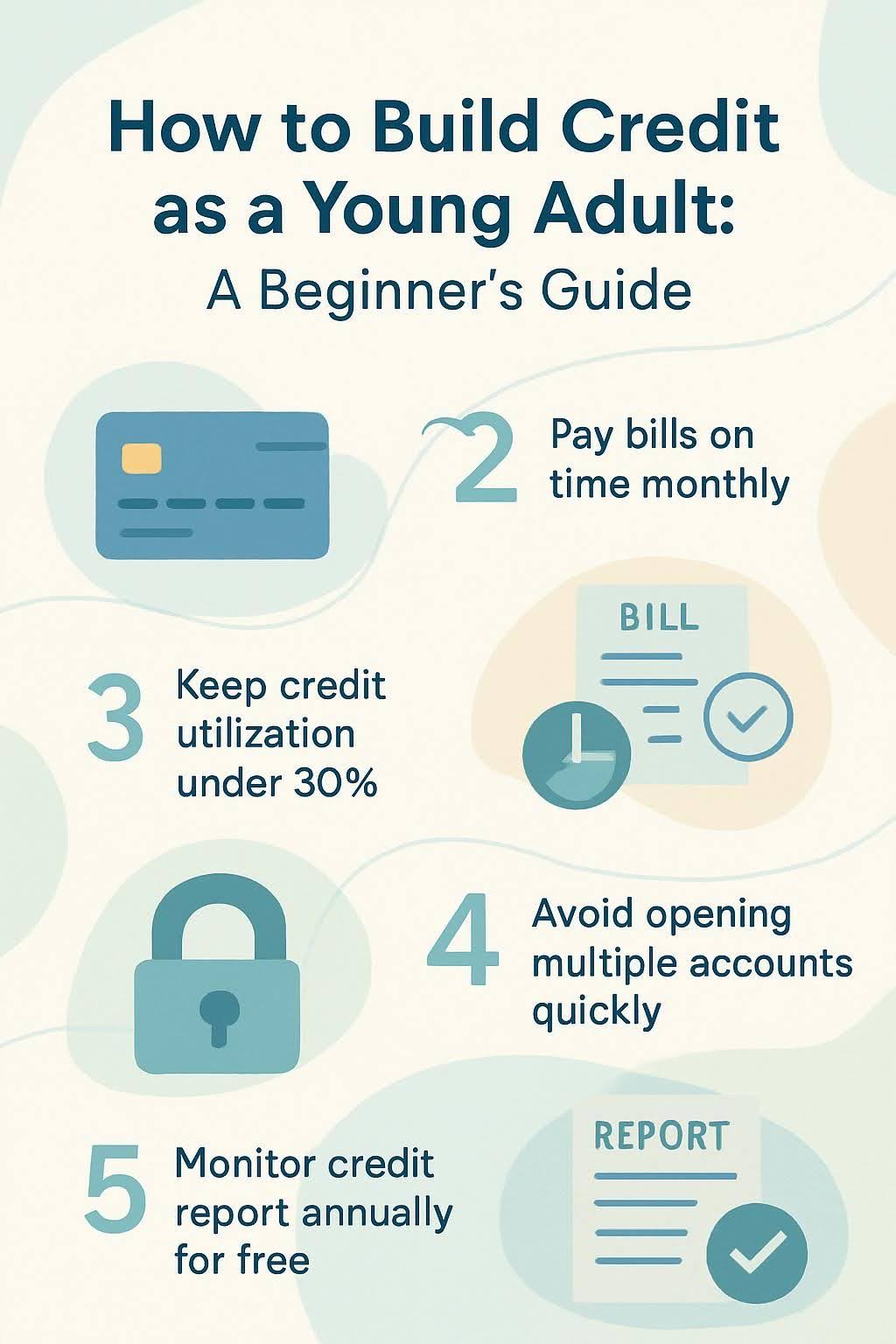

Once you open credit accounts, how you handle these accounts will help you build credit. If you abide by these practices, your score is likely to gradually work.

1. Make Timely Payments

Your payment history has the greatest impact on your credit score. This makes up around 35% of your FICO score.

Why it matters:

- A single late payment can stay on a credit report for 7 years maximum.

- Newer missed payments affect your credit score more than older payments.

- Consistent on time repayment shows reliability to potential lenders.

Strategies for success:

- You should schedule automatic payments for at least the minimum amount.

- Create calendar reminders several days before due dates.

- When possible align payment due dates with paycheckday schedule.

Making at least the minimum payments during difficult financial times is important, but make sure that you do not miss them for any reason.

2. Keep Credit Utilization Low

Credit utilization refers to the percentage of your available credit that you are currently using. This has the second biggest impact on your credit score at 30 per cent.

The ideal approach:

- Keep overall utilization on all revolving credit 30% or less.

- A credit score remains greatest if utilization ratio is below 10%.

Management strategies:

- Make payments throughout the month to keep low balances.

- Request a rise in credit limit after using it responsibly.

- Try to keep old accounts active even if you don’t use them.

To make the most improvement in your credit score, you need to use your cards regularly. However, keep the balance low compared to the limit of the card. This activity shows that you are able to use and manage the credit available to you.

3. Monitor Your Credit Report

Checking your credit reports regularly will help you confirm whether the information is correct. It will also help you catch any problems that could harm your score quickly.

How to access your reports:

- Get free weekly reports from Equifax, Experian and TransUnion at AnnualCreditReport.com.

- Various credit card companies and banks offer free credit monitoring service.

What to look for:

- Accounts you don’t recognize (potential identity theft).

- Incorrect personal information.

- Inaccurate payment histories or account statuses.

- Hard inquiries you didn’t authorize.

When you find an error, dispute it with the credit bureau and the furnisher immediately. The Fair Credit Reporting Act allows consumers to have inaccurate information investigated and corrected.

4. Avoid Frequent Credit Applications

Each time you submit an application for credit, a hard inquiry gets marked on your credit report, causing your score to decrease by some points temporarily.

Best practices:

- Always check the research qualification criteria before applying.

- Space out credit applications when possible.

- Make use of pre-qualification or pre-approval offers that involve soft inquiries.

- It’s better to build history with existing accounts that always opening new ones.

Even though the effect of each hard inquiry is small and fades after a year, too many inquiries in a short timeframe may indicate to lenders that you are financially distressed.

Common Mistakes to Avoid

Being mindful of common credit-building mistakes as you work on your credit can keep you on the right track.

1. Missing Payments

Not making your payments is one of the quickest ways to damage your credit score and the longer the payment is late, the more serious the impact.

The impact:

- Your score can drop more than 80 points after 30 days late.

- Your credit report stays on your credit report for 7 years.

- The more recent the late payment, the greater the impact.

Prevention strategies:

- Set up automatic payments for at least the minimum amount.

- Build an emergency fund covering 3-6 months of expenses.

- Contact creditors immediately if you anticipate payment difficulties.

Your creditors might accommodate your situation better if you buzz them before missing payments. In fact, some lenders offer hardship options, payment plans, and more, which would help you even if you miss a payment.

2. Closing Old Credit Accounts

On the surface, it makes sense to close unused accounts balancing your budget. However, closing these accounts can damage your credit score in a few different ways.

How it impacts your score:

- It lowers your total credit, increasing the utilization ratio.

- Shortens average age of accounts when older accounts close.

- After a while, the positive payment history disappears from your report.

Better alternatives:

- Keep older accounts active by using them periodically for something small.

- If you’re worried about annual fees, ask if you can downgrade to a no-fee card.

One exception to this may be an account with an annual fee whose benefits don’t justify the fee or one whose available credit could lead to an irresistible urge to overspend.

3. Not Having a Mix of Credit Types

Having different types of credit can help boost your credit score. You don’t need a mix of different types of credit when you’re starting out. But as you develop as a borrower, having a credit card (or two) as well as a car loan could help you get a good credit score.

The right approach:

- Don’t take on unnecessary debt solely for credit mix.

- Your requirement for different types of credit depends on your financial needs.

- Manage your money carefully before diversifying.

Over time, many people naturally acquire different types of credit as they make major life purchases and have other financial needs, so this one tends to develop naturally with responsible credit use.

The Next Steps

As a young adult, it takes time to build credit. When you start early, you have an edge over others. You get time to develop positive habits which can prove to be useful. Also, you get extra time to recover from little mistakes before making a big investment.

Remember that credit building is a marathon, not a sprint. Focus on doing what’s right repeatedly, not what’s quick or easy. Every month that you pay your bills on time and maintain low utilization, your credit profile builds little by little.

If you follow this guide, which covers becoming an authorized user, using secured card or a credit-builder loan, making payments, keeping utilization low, and monitoring your reports, you will be well on your way to financial success.

Your future self will probably benefit from having good credit. With a high credit score, you’ll qualify for better interest rates. You’ll also have access to better housing options and even job opportunities. All of these things can give you more financial flexibility. The financial habits you develop now will help you out throughout your entire financial journey.

Recent Comments